SDG Indicator 7.a.1: International financial flows to developing countries in support of clean energy research and development and renewable energy production, including in hybrid systems

1. Key features and metadata

Definition: This indicator aims to show temporal trends in total public international financial flows (i.e. Official Development Assistance (ODA) and Other Official Flows (OOF)) to developing countries in support of clean energy research and development and renewable energy production.

| Sub-indicator | Disaggregated by |

|---|---|

|

EG_IFF_RANDN International financial flows to developing countries in support of clean energy research and development and renewable energy production, including in hybrid systems (millions of constant 2022 USD[1]) |

Type of renewable technology (bioenergy, geothermal, hydropower, marine, multiple, solar, or wind). |

Sources of information: Relevant national administrations (e.g. aid agencies and Ministries of Foreign Affairs, Finance, Treasuries, etc.) through the Creditor Reporting System (CRS) of the Development Assistance Committee of the Organisation for Economic Co-operation and Development (DAC/OECD). International Renewable Energy Agency (IRENA) data is collected from a wide range of publicly available sources, including the databases and annual reports of all of the main development finance institutions and 20 other bilateral and multilateral agencies investing in renewable energy.

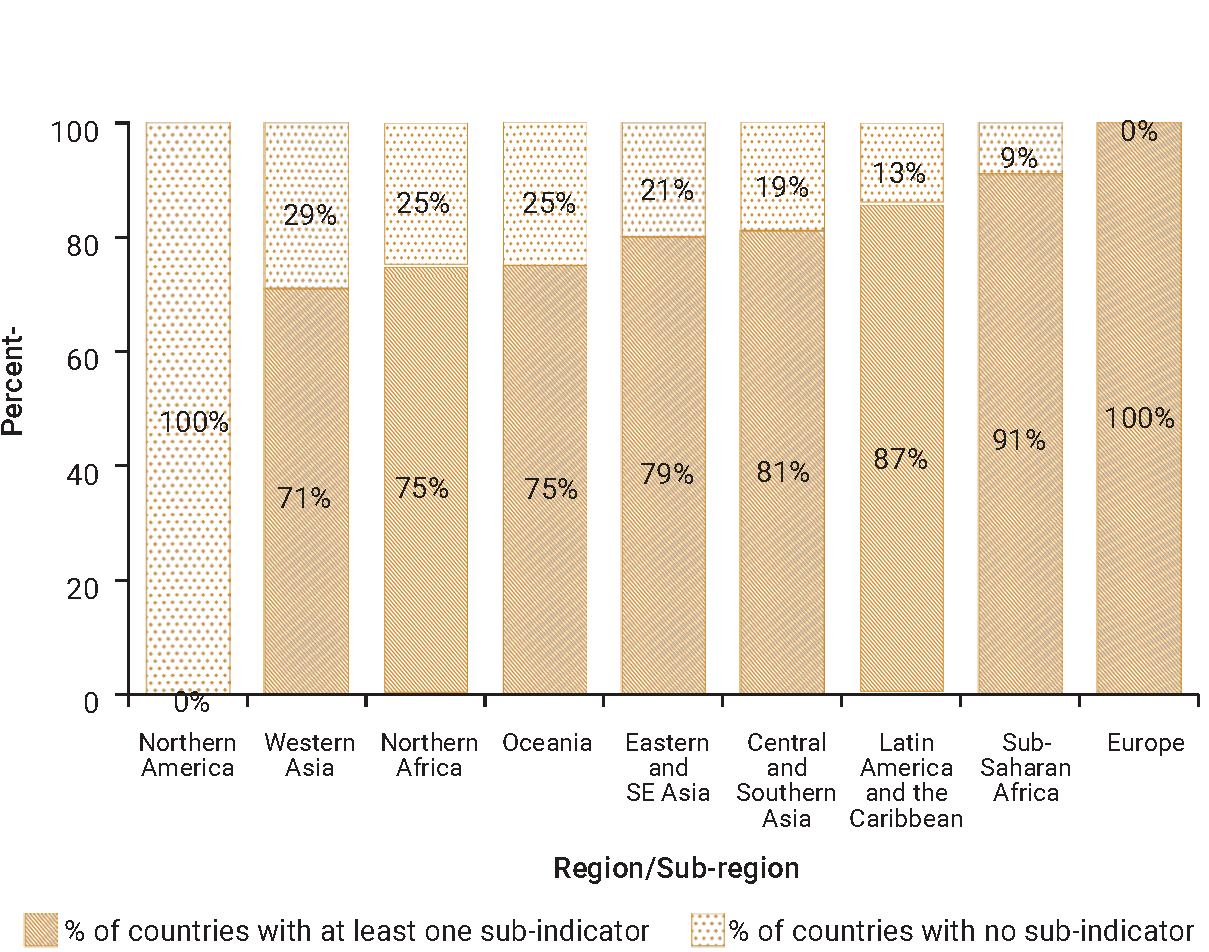

2. Data availability by region, SDG Global Database, as of 02 July 2025[2]

3. Proposed disaggregation, links to policymaking and its impact

| Proposed disaggregation | Link to policymaking | Impact |

|---|---|---|

|

International financial flows to developing countries in support of clean energy research and development and renewable energy production, by donor (millions of constant 2022 USD[3]) (IRENA 2023; OECD 2023a) Applies to:

|

This disaggregation emphasizes the respective share of each donor to the global financial effort of the international community for clean and renewable energy in developing countries. It can be used by decision-makers to identify untapped resources, potential partnerships and cooperation among donors or to leverage existing financing resources. This disaggregation is consistent with the UN Global Roadmap for Accelerated SDG 7 (UN 2021a). |

Energy is at the heart of economic and human development but it needs to be available, accessible and affordable. Forecasts point out that 660 million people may still lack access to electricity and 2 billion people may still be dependent on polluting fuels for cooking by 2030. Indigenous people constitute the largest group without access to clean energy. The lack of access to energy has severe impacts on health, education, gender equality, climate action, and the economy. Nonetheless, international support to developing countries for the development of clean energy technologies has been on the decline over the past years. This jeopardizes the chances of achieving the energy for allgoal forLeast Developed Countries (LDCs), Landlocked Developing Countries (LLDCs) and Small Island Developing States (SIDS). To reach the SDG 7 targets and the Paris Agreement, stronger international commitment will be needed. Especially in delivering additional financial aid in parallel to introducing innovative energy funding mechanisms to transition away from fossil fuels, invest in power generation and infrastructures. Also to introduce the necessary structural reforms to achieve a successful energy transition (e.g. the appropriate regulatory framework, technological transfers or subsidies). Energy transition plans are critical policy instruments for streamlining actions onenergy efficiency, electrification, and renewable energy (IEA et al.2023). Energy transition offers a unique opportunity to bring people into better living conditions, to create new jobs and economic activities, to spearhead new technologies,to empower women, to improve education and health care, and to enhance resilience to climate change (United Nations Economic and Social Council [UN-ECOSOC] 2023). The structure of international financial flows in support of clean energy, the funding of national energy plans and the share of concessional finance (i.e. grants and low-cost project debt, usually provided by public donors) is small (less than 1% in 2020). This is a major impediment to the development of renewables. Securing low-cost debt for developing countries will be needed in the future for the development of capital-intensive renewable energy programmes. While equity financing will still be key to supporting emerging technologies as well as projects with high-risk or limited credit access (IRENA and Climate Policy Initiative [CPI] 2023). |

|

International financial flows to developing countries in support of clean energy research and development and renewable energy production, by type of instrument (millions of constant 2022 USD[4]) (IRENA 2023; OECD 2023a):

Applies to:

|

This disaggregation tracks the respective contribution of each type of financial instrument (e.g. loans, grants or equity) to the global financial effort of the international community for clean and renewable energy in developing countries. It can be used by decision-makers to identify additional resources, potential partnerships and cooperation among donors. It can also be used to leverage existing resources to finance a just, inclusive and equitable energy transition and scale up green infrastructures. This disaggregation is consistent with the UN Global Roadmap for Accelerated SDG 7 (UN 2021a). |

[1] The unit is variable as the base year for the constant prices and exchange rates are updated yearly.

[2] Amended list of countries and regions based on “developing countries” under indicator 7.a.1. Full list of countries accessible from (IEA et al.2024).